Financial Education Spotlight: Are All the Elements of Your Estate Plan in Place?

For individuals with substantial wealth, an estate plan is not just a prudent step—it’s a critical component of comprehensive financial management. As you navigate the complexities of wealth management, ensuring that all critical estate planning elements are in place is essential to safeguarding your legacy and ensuring a smooth transition of assets to your loved […]

The Essentials of Wealth Management: Strategies for Minnesotans

Unlock the secrets to achieving your financial goals with our comprehensive guide on wealth management in Minnesota. Start planning for success today!

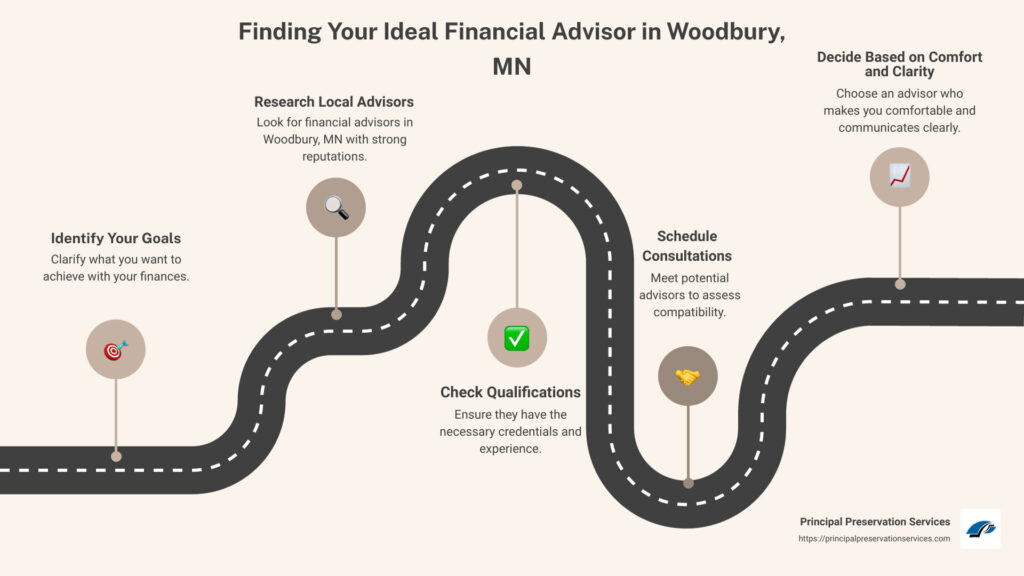

Explore the Best Financial Advisory Services in Woodbury, MN

Discover top financial advisor services in Woodbury, MN for investment, retirement, and tax planning. Secure your financial future today.

The Complete Guide to Planning Your Retirement

Discover how to retire with confidence in our complete guide, covering savings, Social Security, healthcare, and more for a secure financial future.

A Comprehensive Guide to Choosing the Best Retirement Plan

Discover the best plan for retirement with our guide, featuring 401(k), IRA options, and strategies for maximizing savings. Start planning today for a secure future.

The Complete Guide to Investing for Retirement

Discover key strategies to invest for retirement effectively. From IRAs to diversification, learn how to maximize your savings for a secure future.

An Essential Guide to Asset Allocation by Age

Discover the key to financial success with our guide on asset allocation by age. Learn strategies for every life stage to optimize your investment.

Passing an Inheritance to Your Children: 8 Important Considerations

Choosing to Leave an Inheritance Can Impact Many Other Financial Planning Decisions If you have worked hard and planned properly, you may be well situated to leave an inheritance to your children. It can feel very meaningful to be able to provide a financial legacy for your loved ones, but it’s important to be practical, […]

Preparing for Long-Term Care

Did you know that Medicare typically doesn’t cover nursing homes or any in-home care? According to statistics, someone turning 65 today has almost a 70% chance of needing some type of long-term care assistance.1 This includes self-reliant activities such as bathing, eating, getting dressed, using the bathroom, and even getting out of bed. Costs for […]

Alternative Funding Strategies for Long-Term Care

As we get older and become frailer, we may find ourselves needing help with everyday activities that’s as simple as getting dressed, eating, or getting in and out of bed. Even if we’re healthy, accidents may necessitate assistance with such activities. This assistance is called long-term care (LTC) and can be provided at home, in […]