When searching for a financial advisor in Woodbury, MN, you’re looking for more than just advice. You want a partner who understands your goals and can guide you through the complexities of investing, retirement planning, and preserving your principal. It’s about finding someone who speaks your language, offers transparent advice, and aligns with your future aspirations.

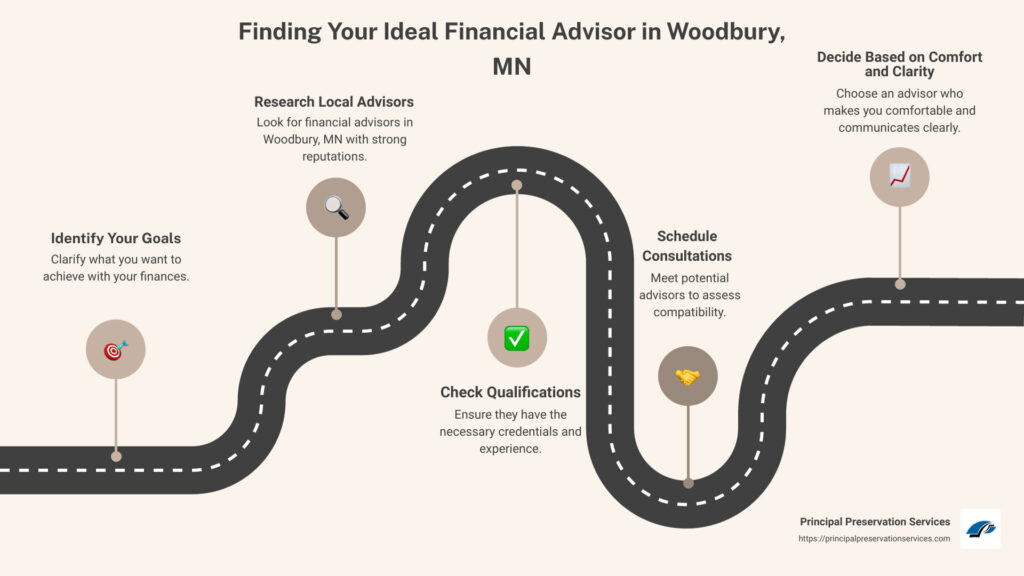

Here’s a quick guide to finding the right financial advisor for you in Woodbury, MN:

– Seek someone who offers a holistic approach to financial planning.

– Ensure they have a track record in retirement and estate planning, as well as tax minimization.

– Look for transparency in how they earn their fees and how they plan to serve your best interests.

– Verify their credentials and experience to ensure they’re qualified to guide you.

– Communication is key: choose an advisor who listens and can explain complex concepts simply.

Whether you’re nearing retirement or seeking to manage your finances more wisely, a financial advisor can be your guide to a secure financial future.

What to Expect from a Financial Advisor

When you’re on the hunt for a financial advisor in Woodbury, MN, knowing what services they offer and how they can aid your financial journey is crucial. Here’s a breakdown of what to anticipate:

1. Investment Management: The cornerstone of most financial advisory services, investment management involves creating and managing a portfolio that aligns with your risk tolerance and financial objectives. The aim is to grow your wealth over time through a diversified investment strategy.

2. Retirement Planning: It’s never too early or too late to start planning for retirement. A financial advisor can help you set realistic retirement goals, calculate the savings you’ll need, and devise a strategy to achieve those goals. This could include saving in tax-advantaged accounts, investing in stocks or bonds, or exploring other income opportunities for your retirement years.

3. Estate Planning: While it may be uncomfortable to think about, planning for what happens after you’re gone is a gift to your loved ones. Estate planning with a financial advisor ensures your assets are distributed according to your wishes, potentially minimizes estate taxes, and can help avoid the complications of probate court.

4. Tax Minimization: Nobody wants to pay more taxes than they have to. Financial advisors can provide strategies for reducing your tax burden, such as tax-loss harvesting within your investment portfolio, choosing tax-efficient investments, or making the most of retirement account contributions and withdrawals.

A good financial advisor doesn’t just focus on one aspect of your finances; they take a holistic approach, considering all elements of your financial picture to craft a personalized plan. This personalized touch ensures that the advice you receive isn’t just generic guidance but a tailored strategy designed to help you meet your specific financial goals and needs.

As you consider working with a financial advisor in Woodbury, MN, the right advisor will work closely with you, adapting your financial plan as your life and the markets change. They should be a trusted partner in your financial journey, helping you navigate the complexities of the financial world with confidence.

Choosing the Right Financial Advisor in Woodbury, MN

Finding a financial advisor in Woodbury, MN that matches your needs is crucial. It’s not just about finding someone who can crunch numbers but finding a partner who understands your dreams and goals. Let’s simplify the process and focus on what matters most: Credentials, Experience, Personalized approach, and Communication style.

Credentials

Start by checking their credentials. Are they a Certified Financial Planner (CFP) or a Chartered Financial Analyst (CFA)? These certifications indicate rigorous training and a commitment to their field. It’s like knowing your pilot is well-trained before you take off.

Experience

Experience matters. How long have they been in the business? Have they worked with clients in situations similar to yours? It’s like choosing a guide for a hike; you want someone who knows the trails.

Personalized Approach

Your financial situation is unique, and so are your dreams. A good advisor doesn’t offer one-size-fits-all solutions. They should take time to understand your specific needs and tailor their advice accordingly. It’s about getting a suit that fits you perfectly, not off the rack.

Communication Style

This is about finding someone who speaks your language. Do they explain complex financial concepts in a way that you understand? Are they available when you have questions? Good communication is the foundation of any strong relationship, including the one with your financial advisor.

The goal is to find a financial advisor in Woodbury, MN, who feels like a partner in your financial journey. Someone who not only has the expertise but also takes the time to understand your goals and communicates clearly. By focusing on these key areas, you’ll be well on your way to building a fruitful relationship that can help navigate the path to your financial goals.

Next, we’ll delve into The Importance of Financial Planning and how it can shape your future.

The Importance of Financial Planning

When we talk about financial planning, think of it as mapping out a road trip for your money. Just like you wouldn’t start a long journey without a route in mind, you shouldn’t navigate your financial future without a plan. It’s all about a long-term strategy, aiming to meet your goals and objectives through smart financial organization. Let’s break down why it’s crucial.

Long-term Strategy

A financial plan isn’t just for next year or the one after; it’s a blueprint for your entire financial future. It involves setting long-term goals like retirement, saving for a house, or your children’s education and figuring out how to get there. Without this roadmap, it’s easy to veer off course.

Meeting Goals and Objectives

Everyone has dreams, but turning dreams into reality requires action and planning. A financial advisor in Woodbury, MN, can help you identify your financial goals and tailor strategies to meet them. Whether it’s securing a comfortable retirement, buying a home, or ensuring your children can attend college without massive debts, a concrete plan makes these goals achievable.

Smart Financial Organization

Managing your finances involves more than just keeping an eye on your bank account. It requires understanding how your investments, savings, debts, and all other aspects of your finances work together. By organizing these elements smartly, you can maximize your wealth and minimize financial stress and risks.

A financial plan also involves preparing for the unexpected. Life is full of surprises – some good, some not so good. Having a solid financial plan means you’re better equipped to handle unforeseen events like a job loss, medical emergencies, or sudden home repairs without derailing your long-term goals.

For those living in or around Woodbury, MN, finding a financial advisor who understands your needs and helps guide you through the complexities of financial planning is essential. These professionals can offer personalized advice and strategies to ensure your financial plan aligns with your life’s goals and dreams.

Financial planning is an ongoing process. As your life changes, so too will your financial needs and goals. Regularly reviewing and adjusting your financial plan with the help of a financial advisor in Woodbury, MN, ensures it continues to work for you, helping you to navigate the financial aspects of life’s journey with confidence.

In the next section, we will explore Key Considerations for Your Financial Health, emphasizing the importance of wealth management, tax-efficient investing, inheritance planning, and insurance needs in your overall financial strategy.

Key Considerations for Your Financial Health

When it comes to securing your financial health, there are several critical areas you need to focus on. These areas are like the pillars of a strong financial foundation, each supporting and enhancing the others. Let’s break down these key considerations:

Wealth Management

Wealth management is not just about growing your money; it’s about making smart decisions that align with your life goals. It’s a holistic approach that considers all aspects of your financial life. A financial advisor in Woodbury, MN, can help you navigate this complex process, ensuring your investments, savings, and financial plans work together harmoniously.

Tax-Efficient Investing

It’s not just about how much you earn but how much you keep. Tax-efficient investing is crucial for maximizing your returns over the long term. Strategies such as choosing tax-efficient investment vehicles, timing the sale of assets, and taking advantage of tax-advantaged accounts can significantly reduce your tax liability. This approach ensures more of your money stays in your pocket.

Inheritance Planning

Inheritance planning is more than just deciding who gets what. It’s about leaving a legacy and doing so in a way that aligns with your values and goals. Whether it’s ensuring your heirs are taken care of, contributing to causes you care about, or minimizing the tax burden on your estate, thoughtful inheritance planning is key. It’s a way to make your hard-earned wealth continue to make a positive impact even after you’re gone.

Insurance Needs

Discussing insurance might not be exciting, but it’s essential for protecting your financial health. From health insurance to protect against medical bills, life insurance to provide for your loved ones, to property and casualty insurance to safeguard your assets, each type of insurance plays a critical role. An experienced financial advisor can help you assess your needs and ensure you’re adequately protected.

In summary, taking a holistic approach to your financial health with a trusted financial advisor in Woodbury, MN, can make all the difference. By focusing on wealth management, tax-efficient investing, inheritance planning, and insurance needs, you’ll be well on your way to achieving your financial goals and securing a stable financial future.

We’ll address some of the Frequently Asked Questions about Financial Advisors to help clarify any doubts and guide you in making informed decisions about your financial advisory needs.

Frequently Asked Questions about Financial Advisors

When it comes to managing your finances, there’s no one-size-fits-all answer. However, some questions come up more often than others. Let’s dive into some of the most frequently asked questions about financial advisors to give you a clearer picture.

What is an appropriate fee for a financial advisor?

Financial advisors can charge in several ways: a percentage of the assets they manage for you, a fixed annual fee, an hourly rate, or commissions on the products they sell you. A typical fee might be 1% of the assets under management annually, but this can vary based on the size of your portfolio and the complexity of your financial situation. It’s crucial to understand how your financial advisor charges and to feel that the value they provide justifies their fee. For more insights into choosing the best financial planner for you, including understanding fee structures, you might find this article helpful: Tips to Help You Choose the Best Financial Planner for You.

How much money should you have to see a financial advisor?

The belief that you need a lot of money to work with a financial advisor is a myth. While some advisors do have minimum asset requirements, many work with clients of all financial backgrounds. The key is finding a financial advisor whose services align with your current financial situation and future goals. Whether you’re just starting to save, managing debt, or looking to invest, there’s likely a financial advisor in Woodbury, MN, who can help.

Is it worth paying for a financial advisor?

Deciding whether to hire a financial advisor depends on various factors, including your financial literacy, the complexity of your financial situation, and your willingness and ability to manage your finances on your own. Many find that the benefits — such as personalized advice, accountability, and expert management of investments, taxes, and estate planning — justify the cost. A good financial advisor can help you make informed decisions, avoid costly mistakes, and potentially grow your wealth more effectively than if you were going it alone.

The goal of working with a financial advisor in Woodbury, MN, is not just about picking investments but about making informed decisions that align with your overall financial plan and life goals. Taking the time to find the right advisor can be a crucial step in securing your financial future.

As we consider the value a financial advisor can bring to your life, let’s reflect on the commitment to transparency and proactive strategies by services like Principal Preservation Services in our next section.

Conclusion

At Principal Preservation Services, we believe in a clear and straightforward approach to financial planning and wealth management. Our commitment to transparency ensures that you’re always in the loop, understanding every aspect of your financial journey. We don’t just manage your finances; we aim to educate and empower you to make informed decisions that align with your long-term goals.

Our services are built around proactive strategies. We understand that the financial landscape is ever-changing, and staying ahead requires adaptability and foresight. Whether it’s adjusting your investment portfolio, planning for retirement, or optimizing your tax situation, we’re always looking for ways to protect and grow your wealth efficiently.

Choosing the right financial advisor in Woodbury, MN, is a significant decision. With Principal Preservation Services, you’re not just getting an advisor; you’re gaining a partner dedicated to helping you achieve financial success. Our team is committed to providing personalized service that meets your unique needs, helping you navigate the complexities of the financial world with confidence.

In conclusion, if you’re looking for a financial advisor in Woodbury, MN, consider Principal Preservation Services. Our blend of transparency, personalization, and proactive strategies makes us an ideal partner for those seeking to secure and enhance their financial future. We invite you to learn more about us and how we can help you achieve your financial goals.

Taking the time to find the right advisor is indeed a crucial step in securing your financial future. With Principal Preservation Services, you’re taking that step with a team that’s genuinely invested in your success.