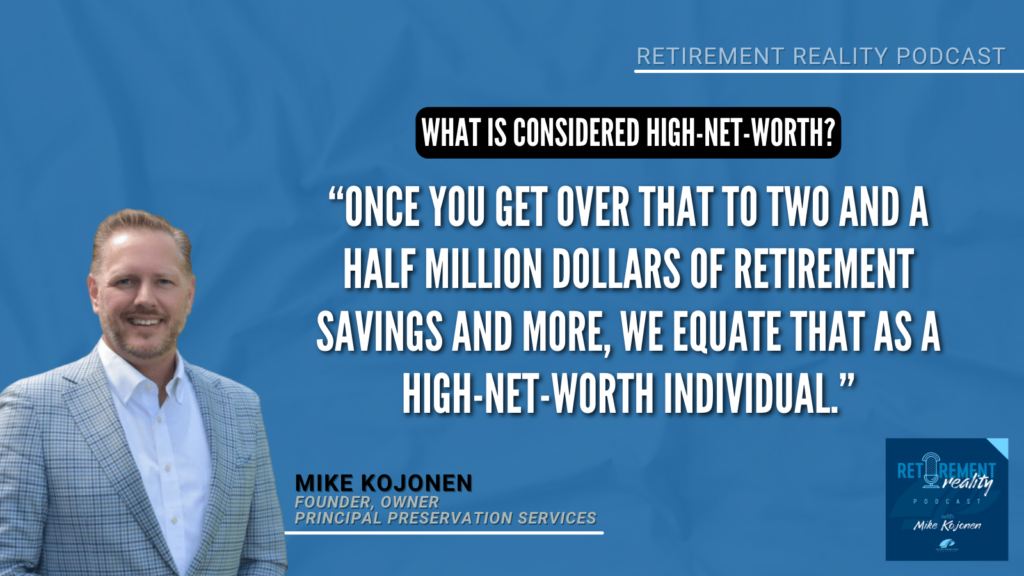

In today’s episode, we’re taking a close look at high-net-worth individuals – those who have accumulated significant wealth and face unique challenges and opportunities when planning for retirement. Unlike the average person, their financial considerations go beyond the basics. We’ll explore the distinct strategies and factors that come into play when securing a comfortable and prosperous retirement.

We will also discuss some common misconceptions surrounding this demographic’s financial planning strategies. Listen in as Mike sheds light on the complexities that come with substantial wealth. At the end of the episode, Mike answers a listener question about required minimum distributions (RMDs).

Here’s some of what we discuss in this episode:

- How Mike would define a high-net-worth individual?

- Some of the complex situations that these people might run into.

- How we work with a client’s CPA to make sure we’re being as efficient as we can with their tax planning.

- 3 retirement myths that hurt high-net-worth individuals.

If you are interested in any of the topics we discussed, please reach out and we would be happy to help you navigate your financial situation.